Seasonal Employment Trends Drive Houston’s July Job Decline

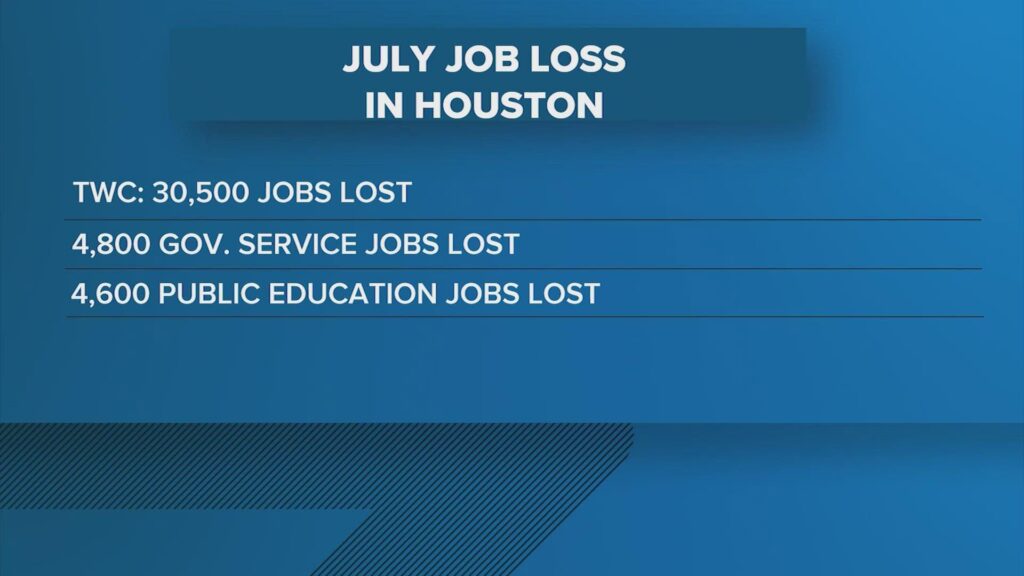

In July, Houston saw a reduction of roughly 30,500 jobs, a figure that aligns with the city’s established seasonal employment cycles. This downturn predominantly impacted sectors that are sensitive to climatic conditions and academic schedules, illustrating the predictable ebb and flow of the local labor market rather than indicating economic instability.

The industries most affected during this period include:

- Construction: Employment decreased as outdoor work slowed due to intense summer heat.

- Leisure and Hospitality: Jobs declined following the peak tourist season, particularly in businesses linked to school vacation periods.

- Retail Trade: A mid-year lull occurred after a surge in June driven by summer sales events.

These patterns have been consistently observed over the last ten years, highlighting Houston’s labor market resilience, which typically rebounds as fall approaches and conditions normalize.

| Industry | Jobs Lost in July | Seasonal Trend |

|---|---|---|

| Construction | 8,400 | Seasonal Decline |

| Leisure & Hospitality | 12,000 | Seasonal Decline |

| Retail Trade | 6,100 | Seasonal Decline |

| Other Sectors | 4,000 | Varied |

Major Factors Behind Houston’s Employment Decrease

The recent employment contraction in Houston is largely influenced by challenges in the energy sector, which remains unstable due to fluctuating crude oil prices and cautious capital expenditure. Energy-related jobs accounted for a significant share of the losses, reflecting reduced drilling operations and a conservative stance on new ventures by industry leaders. Manufacturing also experienced job cuts, driven by ongoing supply chain interruptions and evolving global demand.

Additional sectors contributing to the employment downturn include:

- Construction: Delays in new projects and residential developments have limited labor requirements.

- Retail: Shifts in consumer preferences and the rise of automation continue to reshape employment opportunities.

- Hospitality: Travel uncertainties have kept staffing levels below pre-pandemic figures in hotels and restaurants.

| Sector | Estimated Job Loss | Primary Reason |

|---|---|---|

| Energy | 15,000 | Volatility in oil prices |

| Manufacturing | 6,000 | Supply chain disruptions |

| Construction | 4,000 | Project postponements |

| Retail | 3,000 | Consumer behavior changes, automation |

| Hospitality | 2,500 | Travel-related uncertainties |

Economic Repercussions for Houston’s Small and Medium Businesses

Although the headline figure of 30,500 jobs lost in July may seem alarming, much of this decline corresponds with Houston’s typical seasonal employment shifts. For many local enterprises, especially in retail and hospitality, these changes represent routine adjustments rather than a sudden economic downturn. Nevertheless, sectors like energy and manufacturing, which are pivotal to Houston’s economy, experienced sharper contractions, creating challenges that some small and medium-sized businesses are finding difficult to manage.

Key obstacles confronting Houston’s local businesses this month include:

- Lower consumer spending during the summer lull, impacting non-essential purchases.

- Supply chain bottlenecks leading to inventory shortages and delays.

- Labor shortages restricting operational capabilities in service sectors.

- Instability in the energy market causing cautious investment from related companies.

| Sector | Job Change | Impact on Businesses |

|---|---|---|

| Energy | -12,000 | Reduced investments and project delays |

| Hospitality | -7,500 | Decline in customer visits and hiring freezes |

| Retail | -5,000 | Inventory shortages and decreased sales |

| Manufacturing | -6,000 | Production slowdowns and workforce cuts |

Pathways to Workforce Recovery and Sustainable Job Growth in Houston

Houston’s economy is currently in a phase of adjustment, with recovery dependent on flexible responses to sector-specific changes. Central to this effort are upskilling and reskilling initiatives targeting industries such as energy, healthcare, and technology to align workforce capabilities with emerging market demands. Collaborative programs between educational institutions and businesses are expanding, equipping displaced workers with skills for high-demand roles. Furthermore, Houston’s economic development strategies emphasize nurturing innovation ecosystems and supporting entrepreneurship, which can absorb labor market fluctuations and promote long-term employment stability.

City planners are also focusing on infrastructure enhancements, particularly in transportation and broadband connectivity, to attract new enterprises and improve worker access to opportunities. The following outlines key strategic priorities shaping Houston’s workforce development landscape:

- Collaborative workforce training involving community colleges and private sector partners

- Growth of clean energy initiatives to generate sustainable employment

- Expansion of healthcare services to address increasing community demands

- Support for technology startups to drive innovation and job creation

- Investment in public transit and digital infrastructure to reduce barriers to employment

| Sector | Projected Job Growth (%) | Key Initiative |

|---|---|---|

| Energy | 5.4 | Clean energy workforce programs |

| Healthcare | 7.1 | Facility expansions and service enhancements |

| Technology | 6.3 | Funding for startup incubators |

Conclusion: Houston’s July Job Losses Within Expected Seasonal Variations

To conclude, the reduction of 30,500 jobs in Houston during July represents a significant but anticipated seasonal adjustment rather than an extraordinary economic downturn. Experts highlight that such employment fluctuations are consistent with historical trends, emphasizing the importance of interpreting monthly data within a broader temporal framework. Moving forward, ongoing analysis will be essential to understand how Houston’s labor market adapts through the remainder of the year amid persistent economic uncertainties.